Available insurers

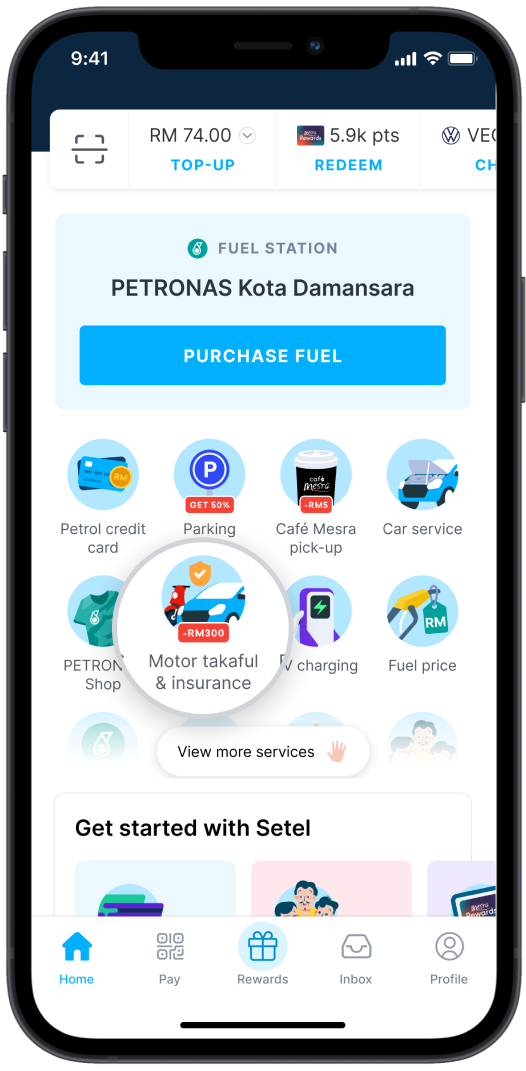

The convenient way to purchase vehicle takaful and insurance

Request quotations, compare and purchase coverage plans all through the Setel app.

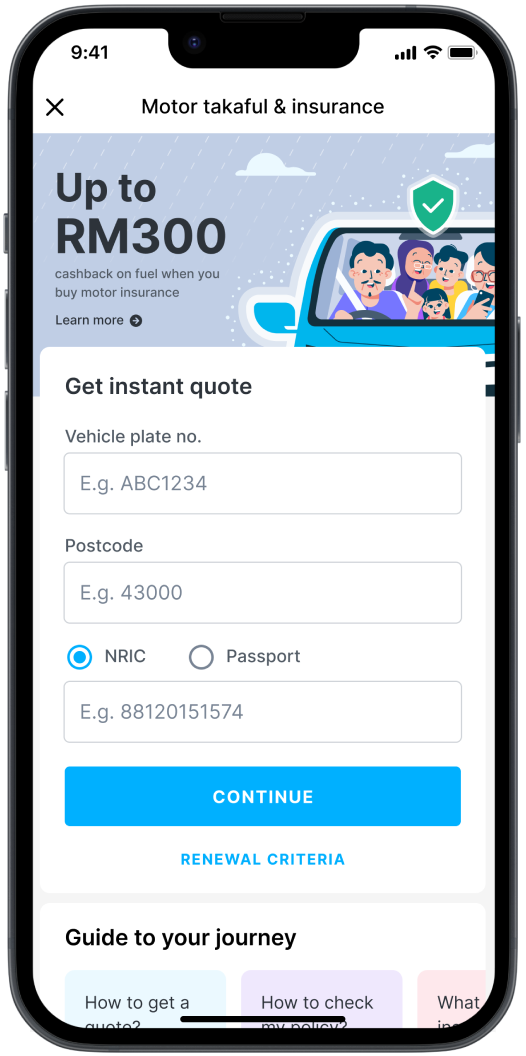

Instant quotation

Get a quotation within minutes on your phone.

Fast approval

Purchase online and receive your e-policy via email in an instant.

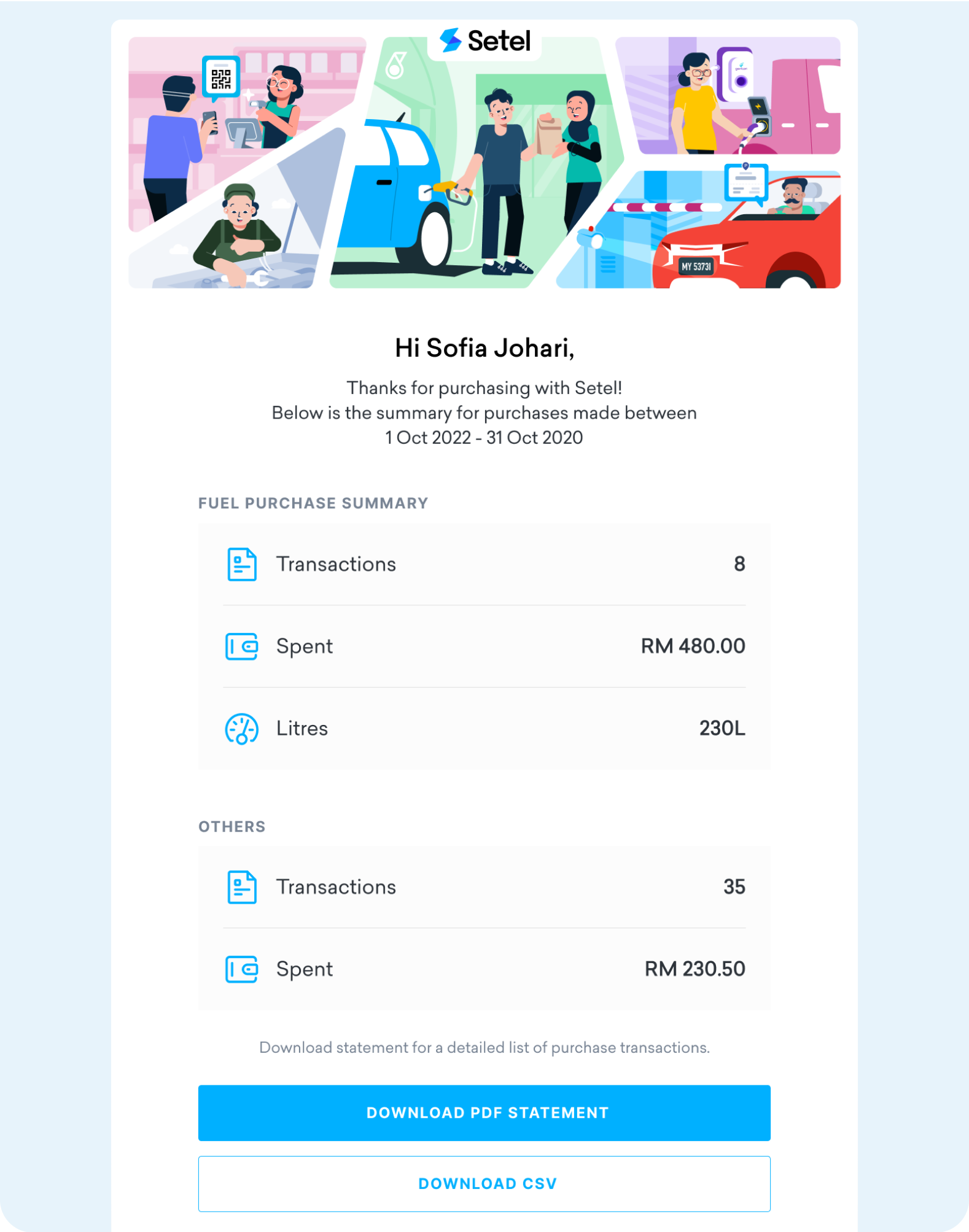

Exciting instant rewards

Unlock seasonal promo rewards, such points or cashback, right after each transaction.

Instant quotation

Get a quotation within minutes on your phone.

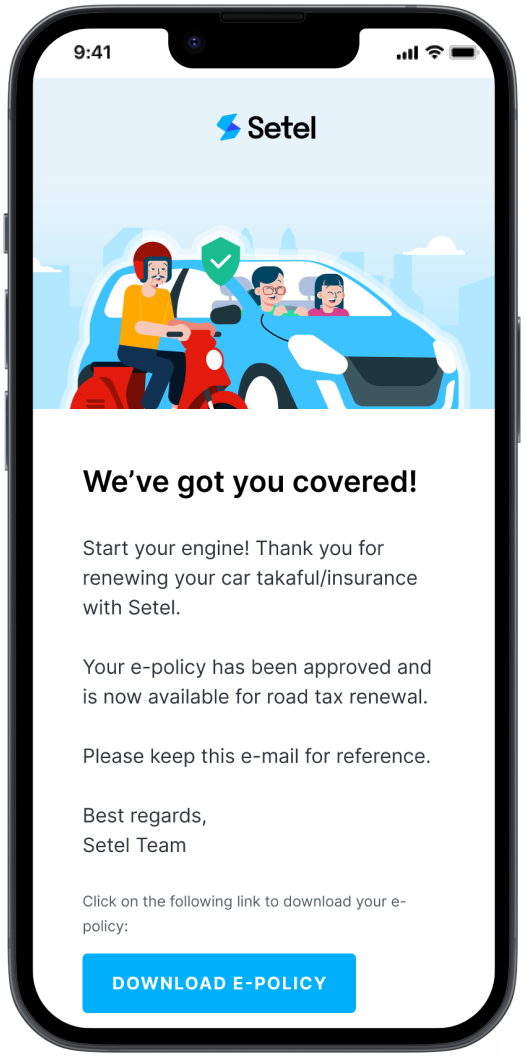

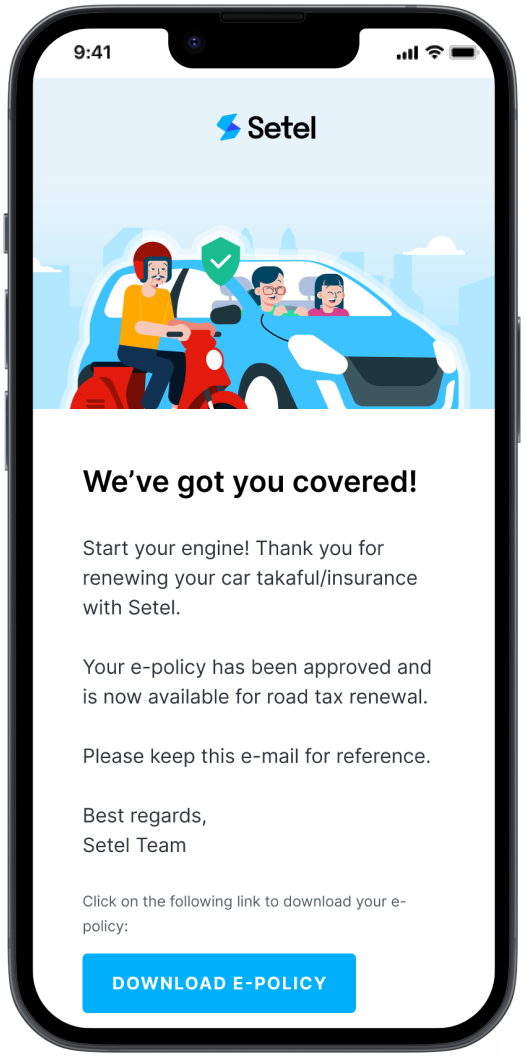

Fast approval

Purchase online and receive your e-policy via email in an instant.

Exciting instant rewards

Unlock seasonal promo rewards, such points or cashback, right after each transaction.

Earn 10% cashback on fuel when you buy motor insurance.

Valid until 31 May 2023. Terms & conditions apply

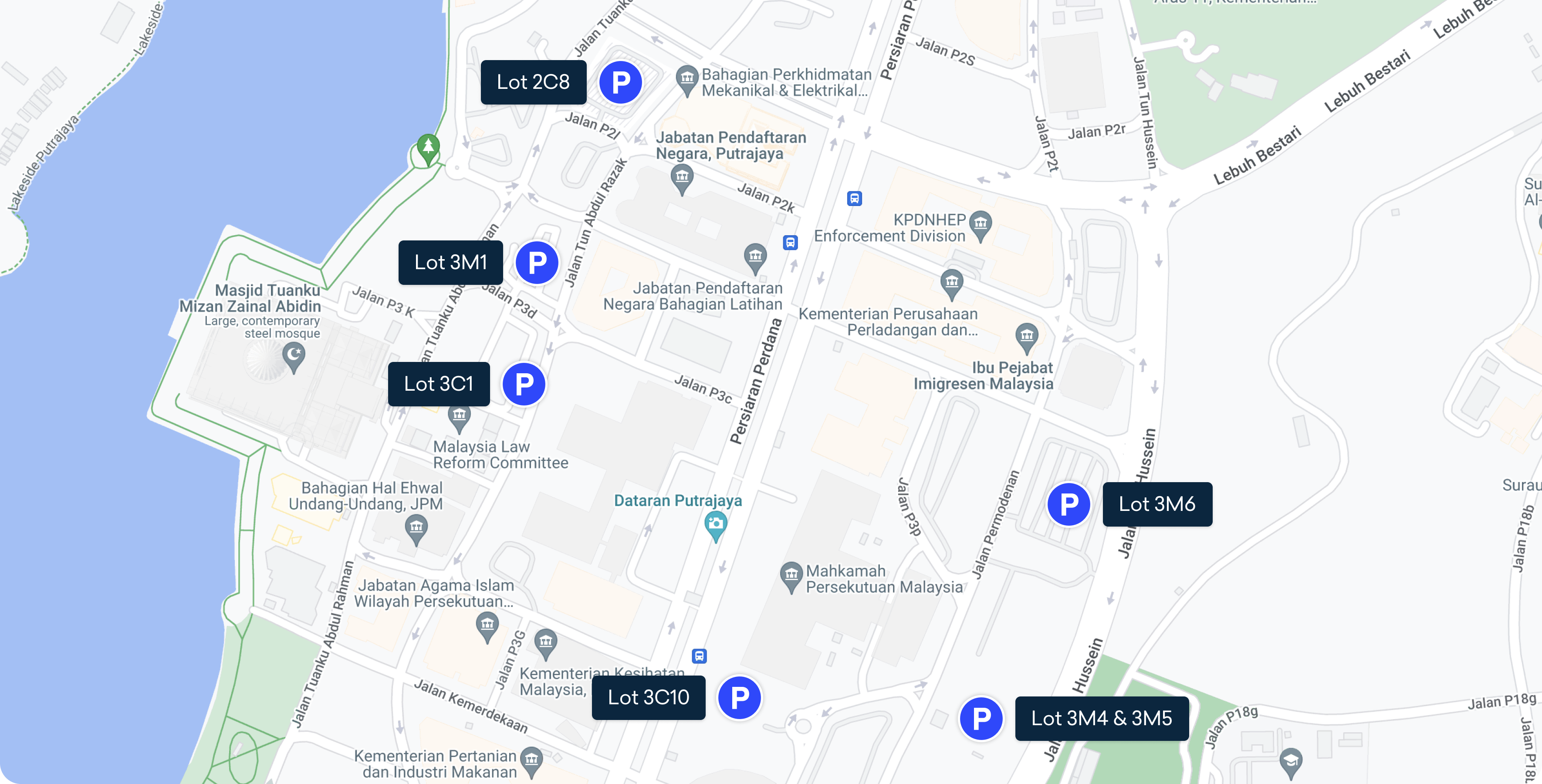

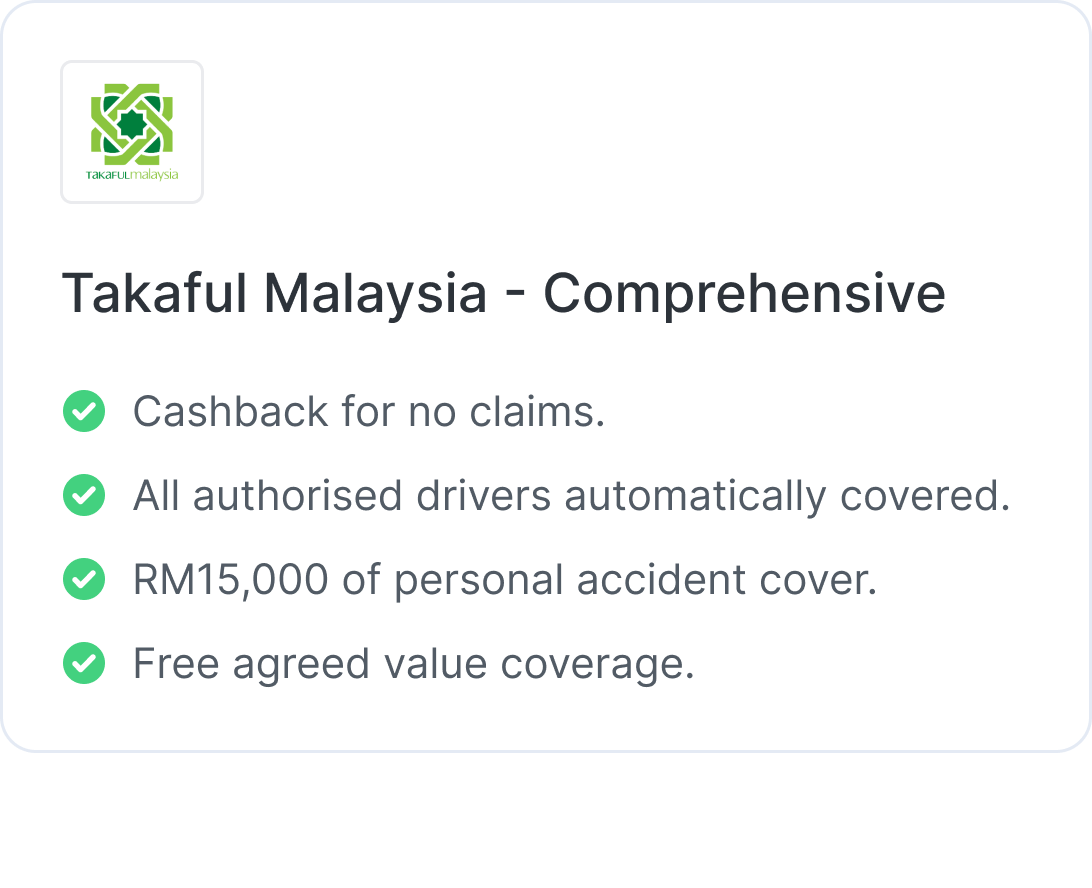

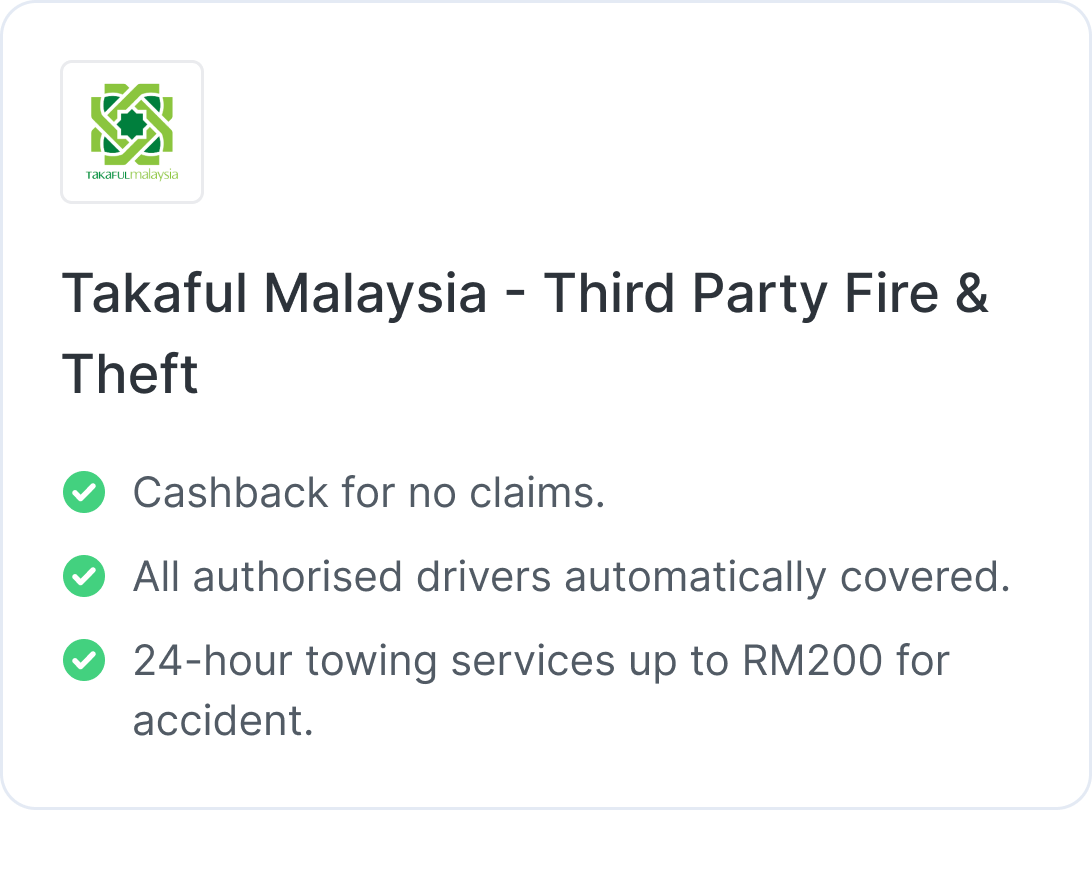

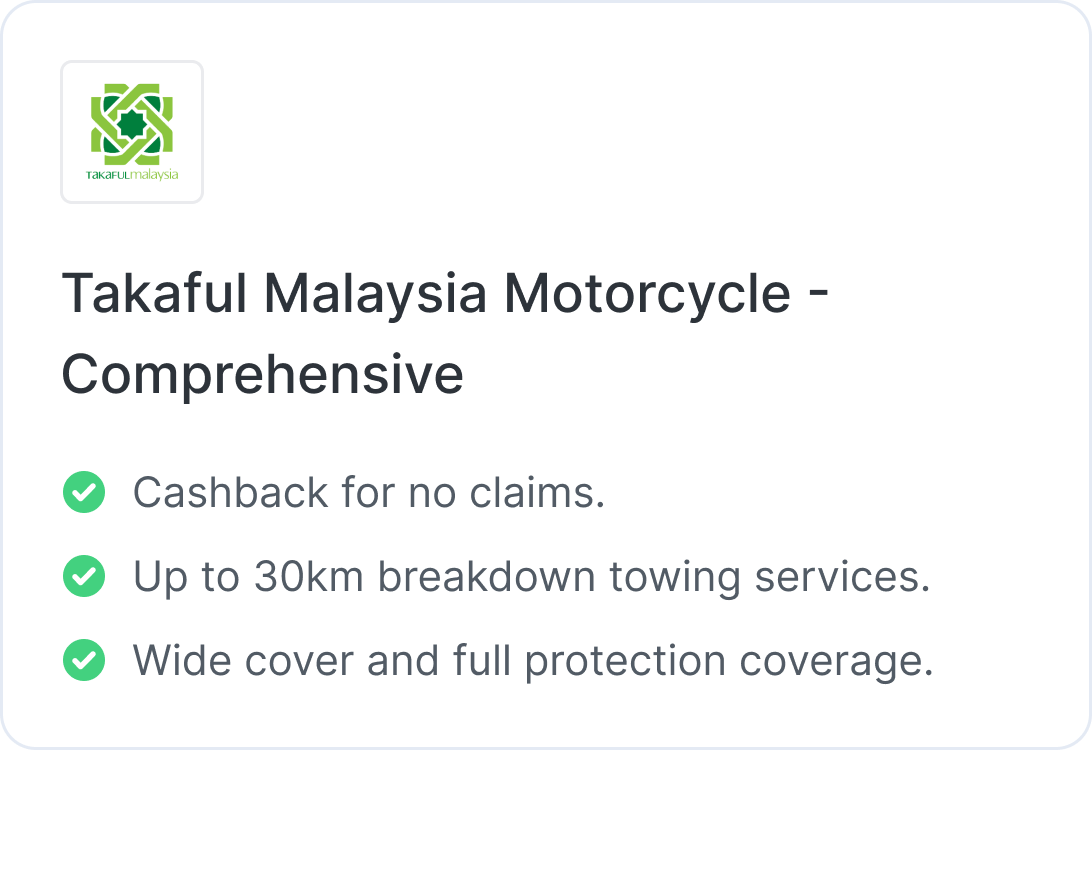

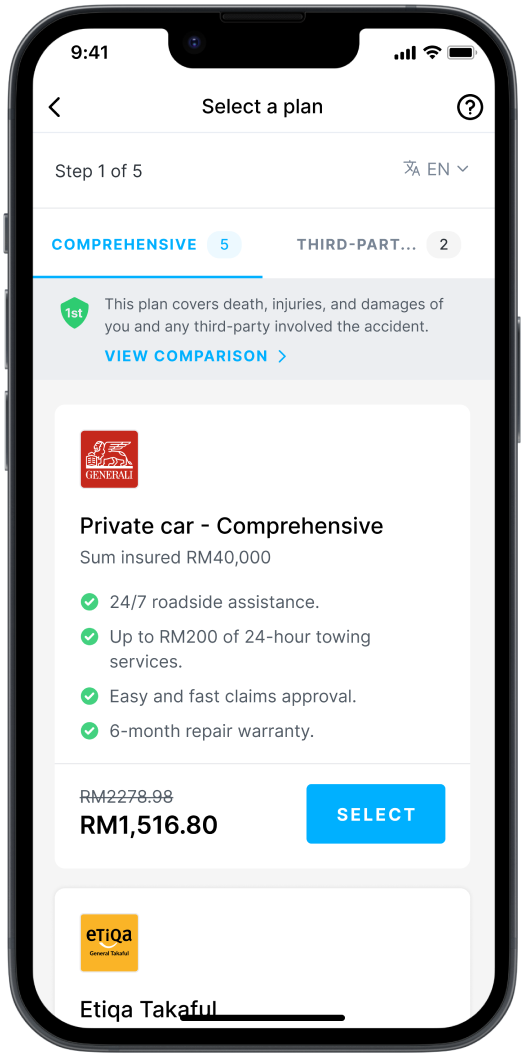

Compare attractive coverage plans by our partners

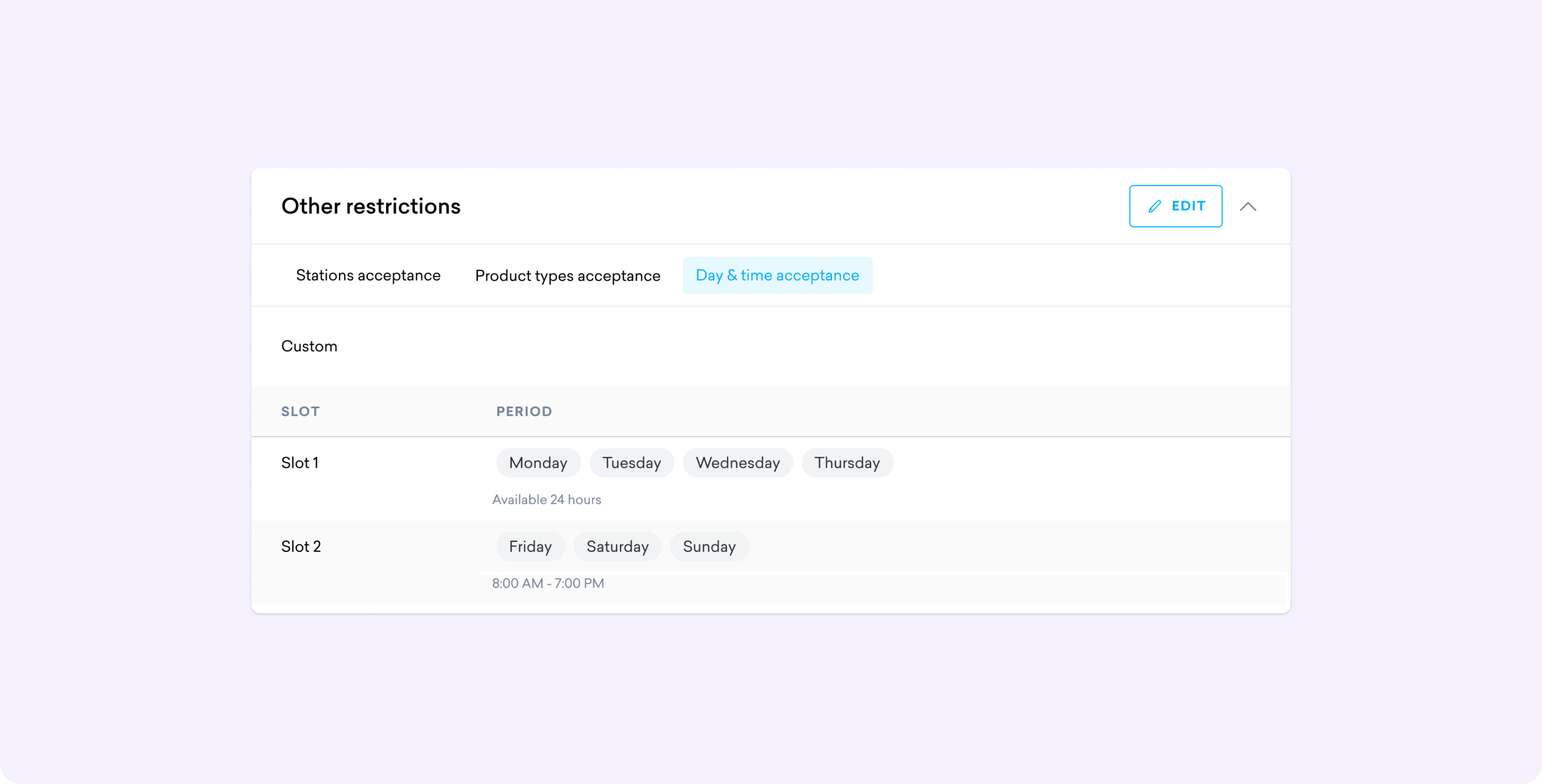

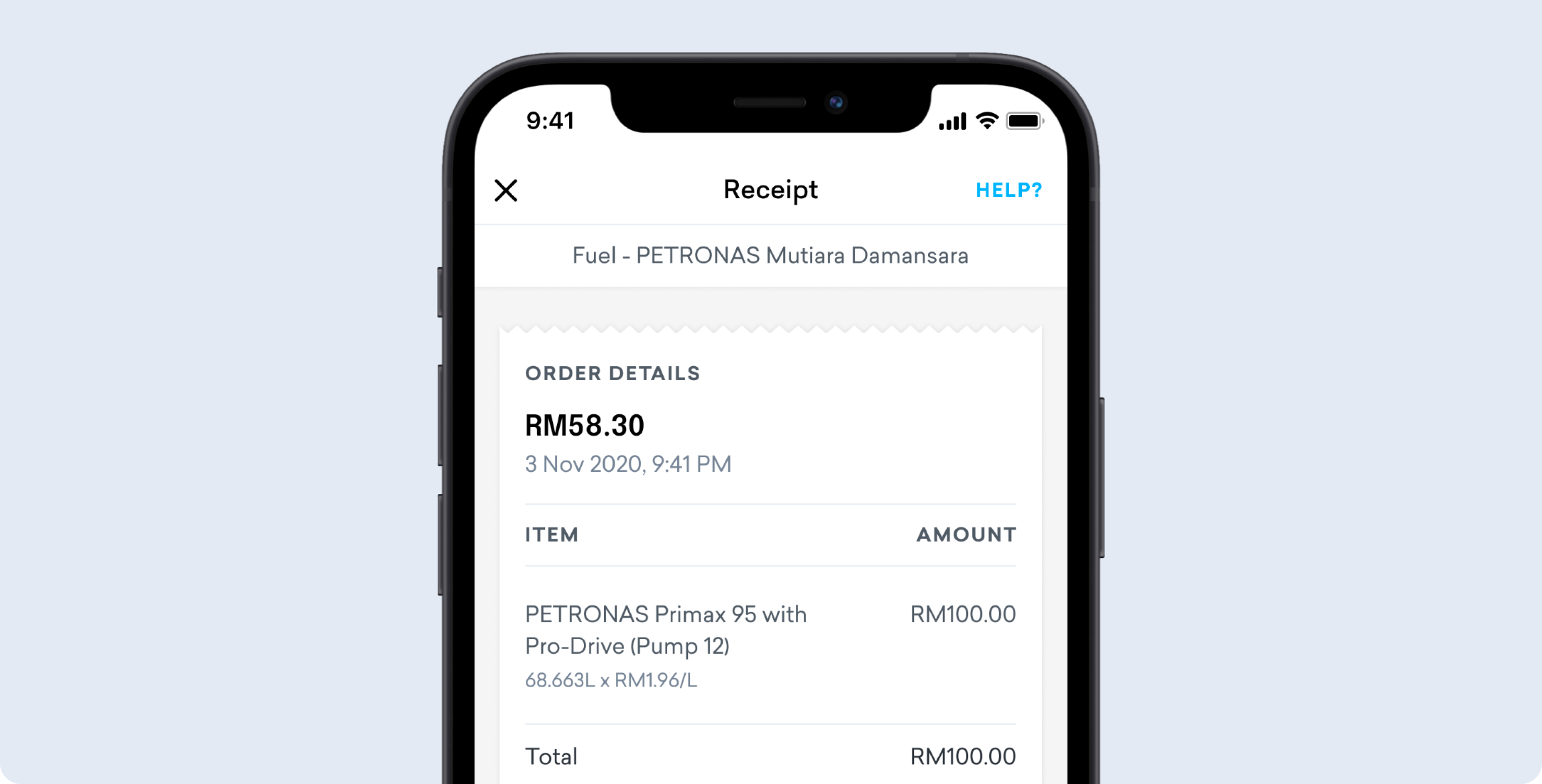

How it works

Get the best protection for your vehicle with a few simple steps.

Step 1

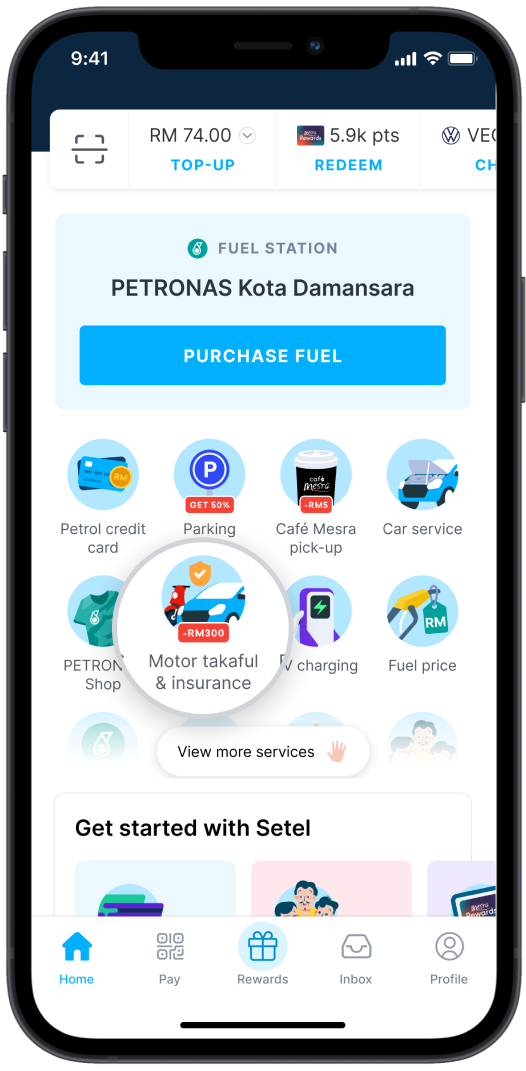

Launch Setel and tap

‘Motor takaful & insurance’.

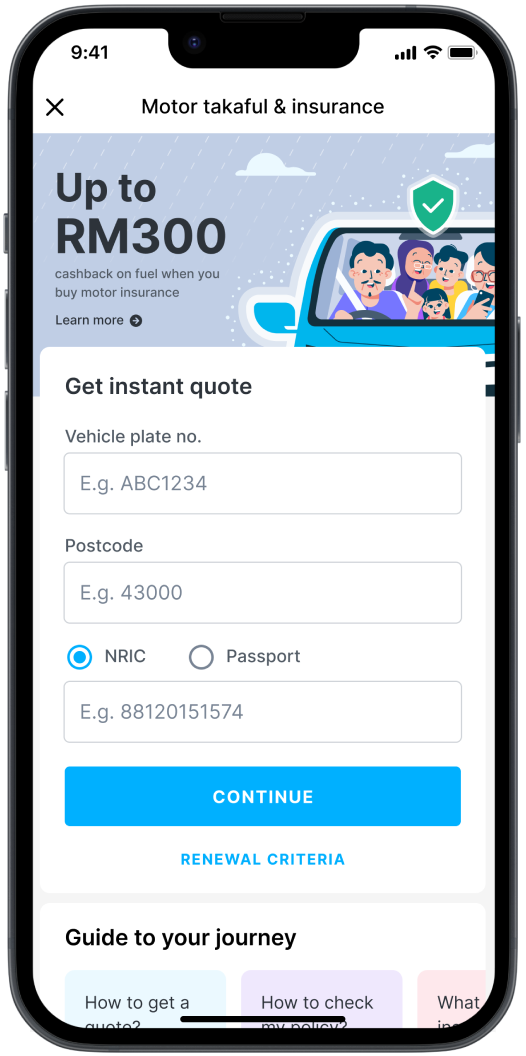

Step 2

Check the renewal criteria and fill out the form.

Step 3

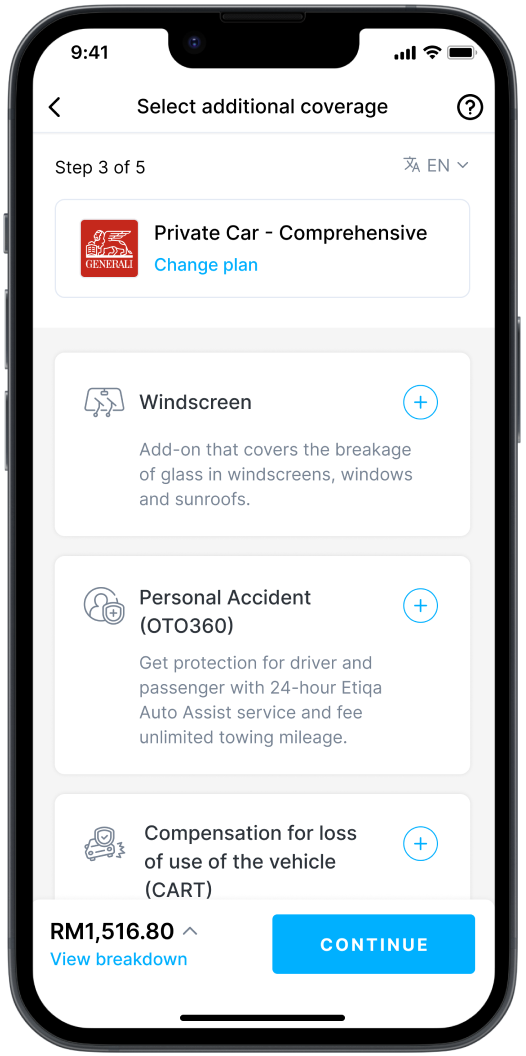

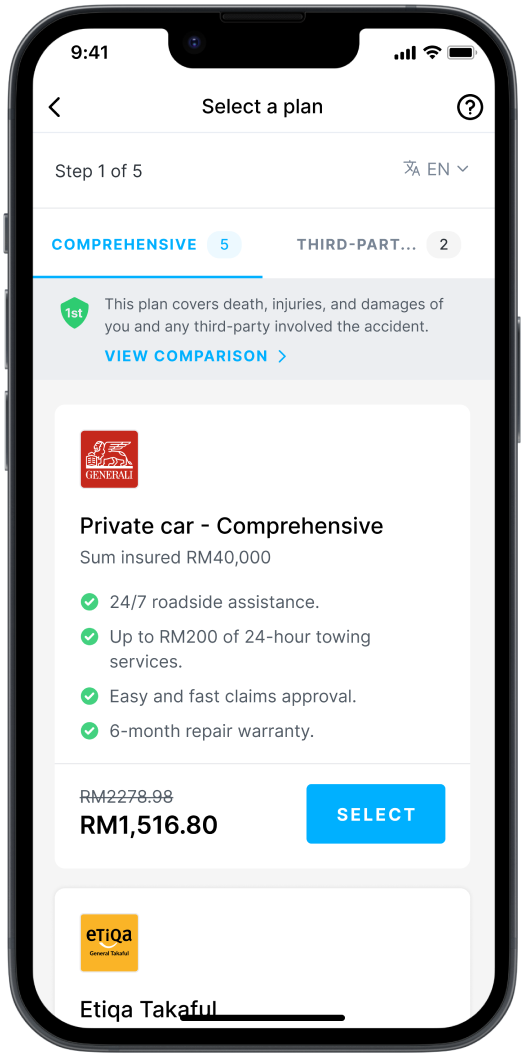

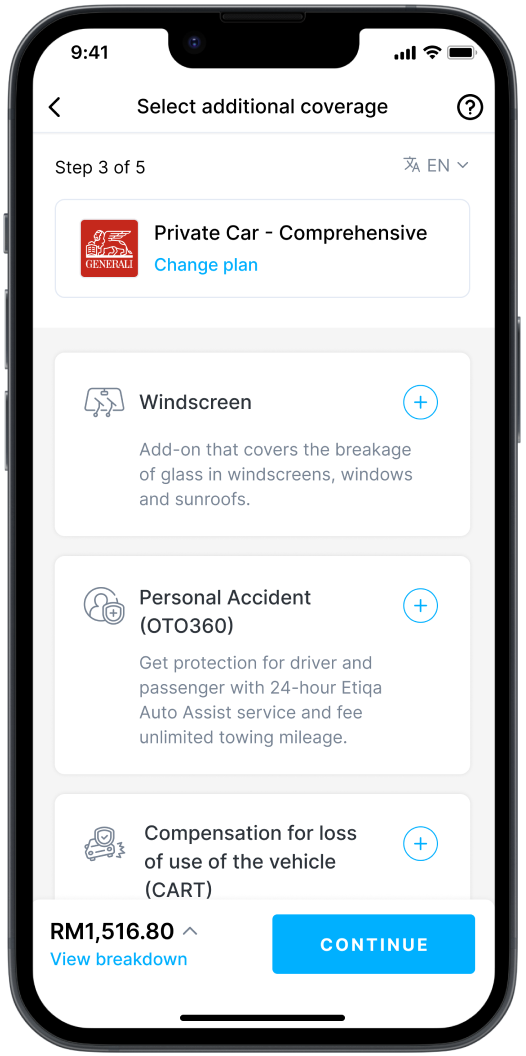

Compare and select your preferred coverage plan.

Step 4

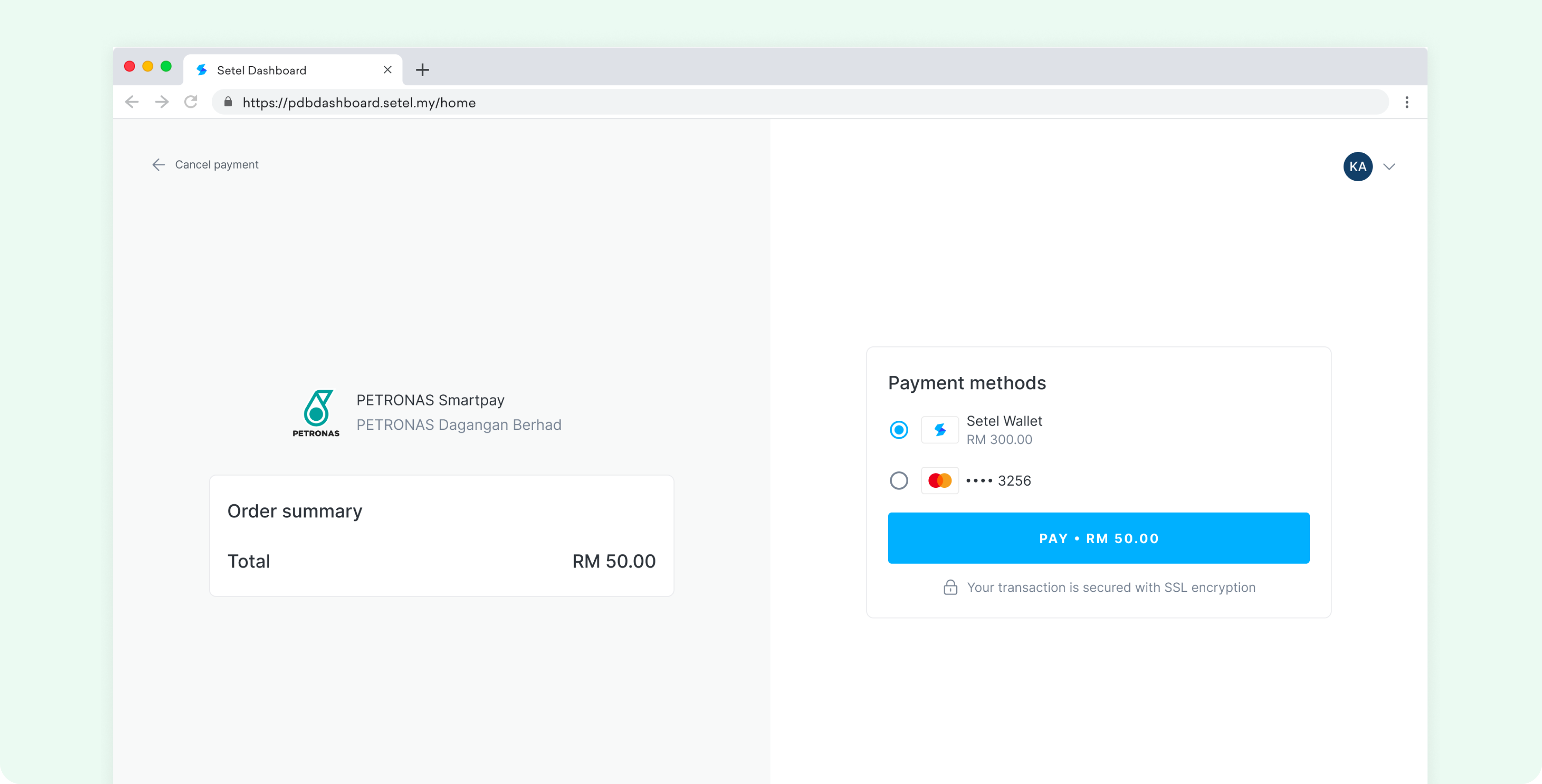

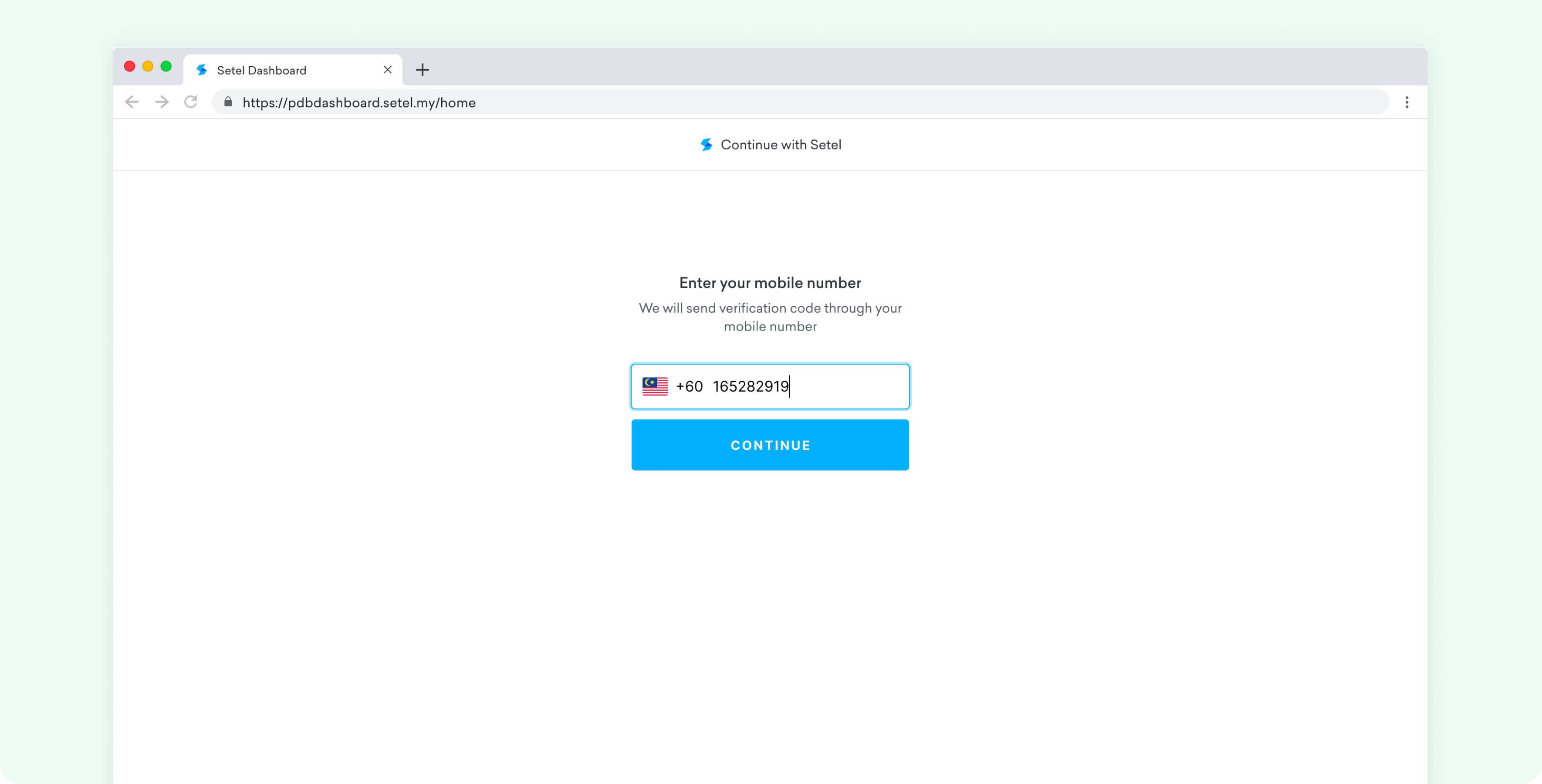

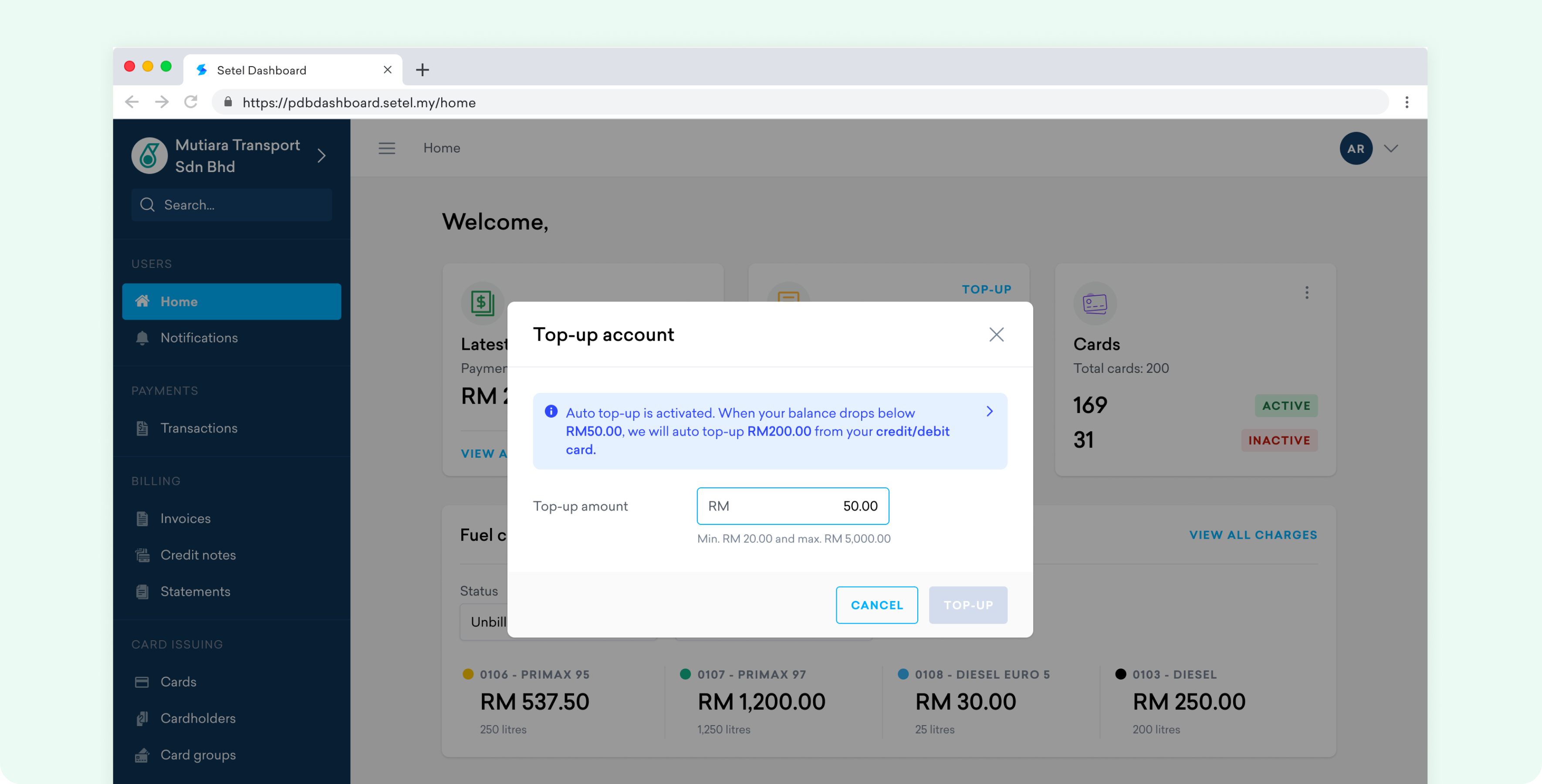

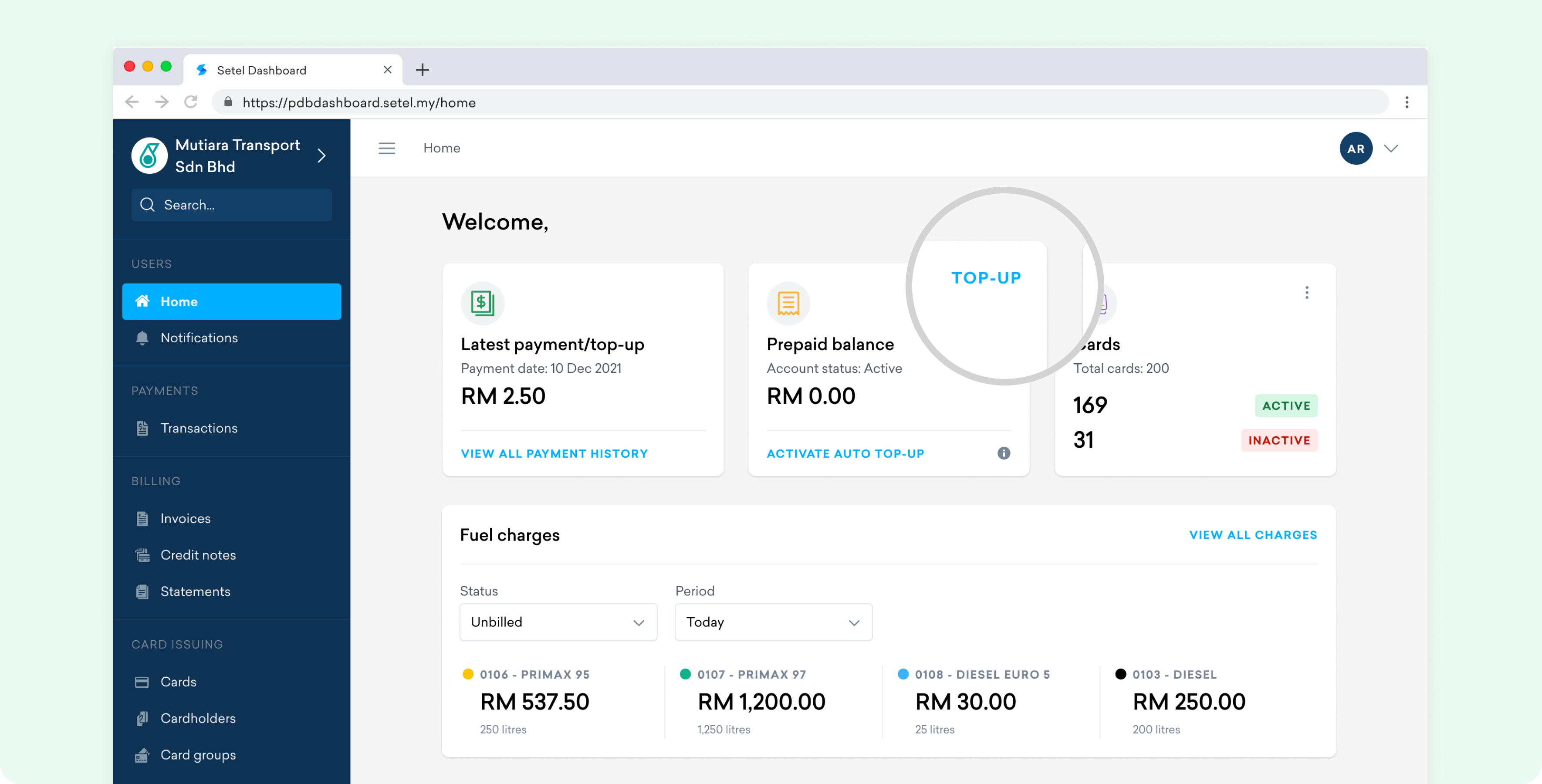

Customise coverage plan and enter personal details.

Step 5

Complete payment and receive e-policy via email.

Hear from our satisfied users

Saya pun memang pakai Setel. Nak buat pembayaran pun mudah. Saya tak perlu nak transfer ke agent.

M. Safuan

Cepat je. Dalam setengah jam saya dah dapat cover note. Kemudian saya boleh terus pergi pejabat pos dekat dengan office dan renew road tax dalam masa sehari.

A. Azwa

So easy to do everything. No individual website where I need to key in multiple info. Since the app already have my payment info (card number), I just need to key in my IC & plate number.

Aumy A.

We can renew your road tax, too!

Have your vehicle road-ready by renewing your road tax with Setel. Do it all with just a few taps through the app.

Need more info?

Just head on to our Help Centre for more in-depth information about Setel.